Investing for Beginners: How to Buy Your First Investment Property

Investing in property is one of the most effective ways to build long-term wealth, but navigating the process alone can feel overwhelming. That’s where we come in. At Dwyer Property Investments, we don’t just provide guidance - we actively work with you at every step, making the process seamless and stress-free. Here’s how we help you turn your property investment goals into reality.

Step 1: Understanding Your Financial Position

Before making any moves, it’s crucial to assess your finances, and we help you do just that.

- Review Your Savings: We help you determine how much you have available for a deposit and whether any financial structures could work in your favour.

- Evaluate Your Borrowing Capacity: We connect you with trusted mortgage brokers who assess your income, expenses, and credit history to determine your borrowing power.

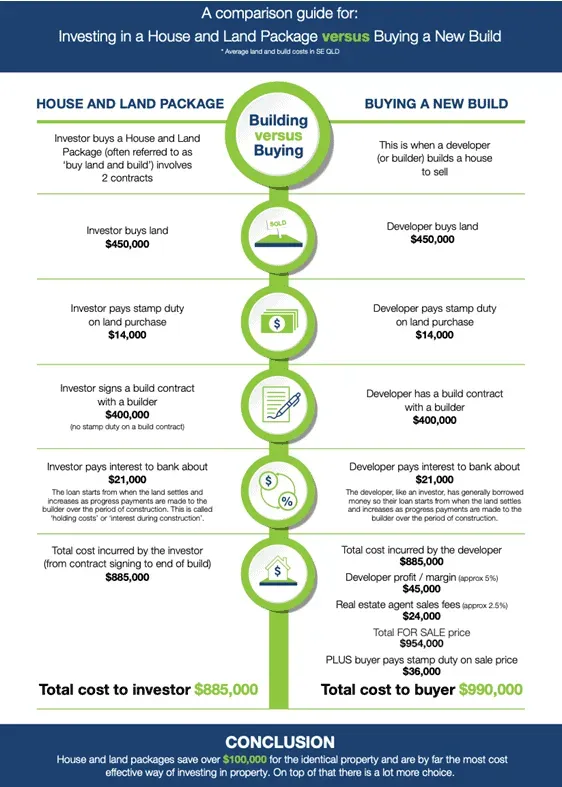

- Account for Additional Costs: From stamp duty to legal fees, insurance, and property maintenance, we ensure you have a complete financial picture before making a decision.

Pro Tip:

Our free consultation includes a full financial overview, using our cash flow software to map out all costs, potential tax benefits, and your investment returns.You can learn more about our discovery session here.

Step 2: Defining Your Investment Goals

We work closely with you to establish what success looks like for your investment:

- Capital Growth: Are you aiming for a property that appreciates in value over time?

- Rental Income: Do you want steady rental income to offset costs?

- Long-Term Wealth Creation: How does this investment fit into your overall financial future?

By clarifying your goals, we tailor an investment strategy that aligns with your vision.

Step 3: Market Research – We Do the Heavy Lifting

Finding the right property in the right location is key, and we use our expertise to pinpoint the best opportunities for you.

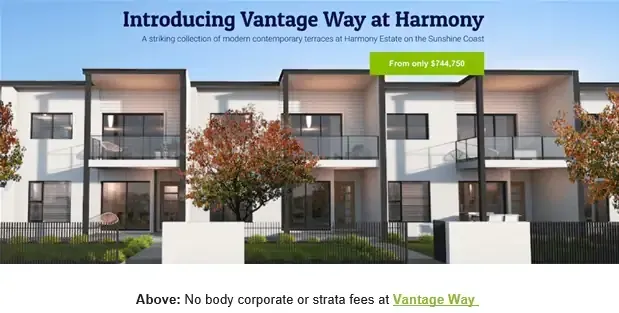

- High-Growth Areas: We identify locations with strong rental demand and capital growth potential (like the Sunshine Coast, where we’ve seen consistent returns!).

- Rental Yields: Our research includes areas with low vacancy rates and high rental yields.

- Property Type: Whether it’s a house, duplex, or townhouse, we guide you on what works best for your investment goals.

Helpful Tip:

We use advanced data tools like CoreLogic, realestate.com.au, and local council reports - so you don’t have to. Plus, we offer free strategy sessions where we walk you through market insights and tailored opportunities. Book your free, no obligation call today.

Step 4: Building Your Expert Team – We’ve Got You Covered

A successful investment requires a strong team. We connect you with trusted professionals who streamline the process:

- Mortgage Brokers – To secure the best loan terms for your needs.

- Real Estate Experts – We find and assess high-quality investment properties for you.

- Solicitors & Conveyancers – To ensure contracts and settlements are handled smoothly.

- Property Managers – We offer property management services or connect you with trusted managers to handle tenants, maintenance, and rental collection.

Step 5: Securing Financing – We Guide You Through It

Once we identify the right property, we help you finalise your financing:

- Loan Pre-Approval: We ensure you're pre-approved before making an offer.

- Interest Rates: Our experts help you choose between fixed or variable rates.

- Loan Features: We break down options like offset accounts and interest-only repayments so you can choose what’s best for your strategy.

Step 6: Conducting Due Diligence – We Ensure No Surprises

Before proceeding, we thoroughly assess the property to safeguard your investment:

- Property Inspection: We arrange professional inspections to check for any structural issues.

- Valuation Reports: We ensure you’re paying the right price for the property.

- Rental Appraisal: We confirm expected rental income to ensure the numbers work in your favour.

Step 7: Making the Purchase – We Handle the Process With You

When it’s time to make an offer, we support you throughout the negotiation and settlement process:

- Negotiation Support: We help you negotiate a fair purchase price and favourable settlement terms.

- Contract & Settlement Management: Our legal experts ensure everything runs smoothly so you can focus on your investment.

Step 8: Managing Your Property – We Offer Stress-Free Solutions

Once you own the property, the next step is ensuring it performs well. We offer full property management services, including:

- Tenant Selection: We help you find reliable tenants or provide a three-year rental guarantee - a perfect option for first-time investors looking for peace of mind.

- Ongoing Maintenance: We ensure your property remains in top condition.

- Rent Reviews: We help you optimise rental returns by keeping your property competitive in the market.

Final Thoughts – We’re With You Every Step of the Way

Investing in property is a life-changing decision, but you don’t have to do it alone. At Dwyer Property Investments, we don’t just advise, we partner with you to make property investing simple, profitable, and stress-free.

Ready to take the next step? Book your free consultation today, and let’s start building your investment portfolio together.

Ready to Start Your Investment Journey?

Take the guesswork out of property investing with guidance backed by 40 years of experience.

Book a free Discovery Session and get a clear plan tailored to your goals.

Your pathway to property wealth starts here

Download your free Strategic Investor's Guide to Southeast Queensland and learn:

The key signals driving demand in Moreton Bay, Sunshine Coast, and Gympie

Which micro-markets & product types fit common investor strategies

Our DPI Playbook to select and de-risk stock

Light case studies to make it real

The Waraba City (Caboolture West) opportunity and timeline

Next steps to get personalised suburb shortlists

Download your free Strategic Investor's Guide to Southeast Queensland

Thank you!

Please try again later.

Recent Posts